Orchestrating Trust, Timing, and Capital Flows – The DeFi GTM Playbook (best practices and learnings)

by Henry Krause and Gleb Dudka – January 9, 2026

Ever since the turbulent events of 2022, the DeFi landscape – and with it, the protocol go-to-market (GTM) playbook – has been constantly evolving. We’ve seen protocols rise to prominence and maintain their positions, while others have lost their early momentum just as quickly as they gained it.

This research takes a retrospective look at some of the most notable and ambitious DeFi GTM strategies – analyzing which approaches succeeded, which fell short, and why. By identifying common patterns across these launches, we aim to distill key lessons and actionable insights that today’s protocols can apply to design more resilient and effective GTM strategies.

TL;DR

- DeFi GTM has become a game of orchestrating trust and capital flows, with narratives and timing often mattering more than product readiness.

- Three GTM pillars dominate recent cycles: risk curators for scalable growth, yield/OTC syndicates for launch liquidity, and riskless vaults for attracting early billions.

- Riskless pre-deposit vaults emerged as the most repeatable play, driving massive TVL through minimal contract risk and strong airdrop expectations – as seen with EigenLayer, Blast, Berachain, and Plasma.

- Early TVL is largely mercenary and whale-driven, making post-launch retention dependent on real utility, ecosystem readiness, and community alignment.

- Sustained success depends on converting speculative inflows into embedded liquidity, turning launch momentum into durable participation beyond the airdrop.

The first part of this research will highlight the three major trends that shaped protocol launches of the last couple of years:

- Risk curator meta

- Yield and OTC clubs

- “Riskless” vaults

The second part will draw conclusions from four major launches that placed riskless vaults at the center of their GTM strategies: Eigenlayer, Blast, Berachain and Plasma.

PART I – Top 3 GTM Strategies

Risk curators – Bridging complexity, capital, and user access

DeFi market participants often face steep learning curves in assessing risks and navigating novel protocols. The most prominent example is the vertical of yield tokenization, which was invented in early 2021. It took 3 years for this vertical to take off and attract billions in total value locked (TVL). Yet, there are still significant frictions in this market, as rolling over expired positions still leads to problems not only for users but also for associated protocols, as it’s a window where funds could leave the protocol. This is where “Risk Curators” come into play. Pioneered by Morpho and Euler, specialized entities have emerged to bridge the gap between complex risk management and user-friendly participation. Curators such as Gauntlet, Steakhouse Financial, MEV Capital, and Re7 operate as on-chain entities that abstract away the underlying complexity, offering users a simplified deposit interface instead. For example, in lending markets, users no longer need to actively move their position from vault to vault chasing the highest return; instead, the risk curator takes over this task while simultaneously running monitoring scripts, enabling much faster reaction times in case of critical events than a retail user could ever do. In return, the curators receive a % performance fee on the TVL sitting in their vaults.

Why should risk curators be part of your go-to-market strategy?

Onboarding risk curators allows protocols to evolve into truly permissionless financial infrastructure – platforms upon which new businesses can be built. In this model, the protocol no longer depends on its core team to whitelist or onboard new vaults. Instead, risk curators can leverage frameworks like Euler or Spectra, among others to expand their own operations: conducting business development, offering customized tokenized yield vaults, and forming new partnerships on top of existing protocol infrastructure.

This shift significantly enhances capital coordination, as these sophisticated entities share a vested interest in growing the protocol’s ecosystem and increasing TVL across its vaults.

If you are a protocol looking to integrate your assets with the previously mentioned platforms, it is equally important to build relationships with their curators, many of whom manage substantial assets, often in the billions, which they aim to deploy efficiently. However, these curators operate within internal risk frameworks that impose allocation limits, resulting in pockets of idle capital eager for high-quality opportunities. For example, with risk curators on Spectra, there could be an incentive for new protocols also to tokenize their new stablecoins to receive an allocation from the existing liquidity that these curators manage.

Yield syndicates and OTC clubs – Orchestrating launch liquidity and attention

While risk curators and capital coordination are key to building sustainable liquidity over time, it’s equally important to ensure that some capital is already committed on launch day. Early commitments can be facilitated by entities such as Turtle Club or other syndicates, which specialize in arranging negotiated off-chain or hybrid deals. In these setups, large liquidity providers commit funds in exchange for enhanced yields, exclusive token allocations, or additional perks like boosted points and airdrops for being the earliest participant in a protocol.

This launch-day momentum is critical from a go-to-market perspective. A protocol debuting with only a small TVL – say $1M – often struggles to capture retail or media attention compared to one that launches with $50M already locked. Morpho, for instance, benefited greatly from this approach in its early days, having secured millions in deposits before going live.

Communities like Turtle Club also serve an additional role in visibility and trust-building. Their Telegram channels regularly feature upcoming opportunities, drawing the attention of large LPs who actively monitor these spaces. These interactions can lead to direct relationships between professional LPs and protocol teams, building confidence and opening the door to customized deal structures or deeper partnerships.

Riskless vaults – Turning pre-deposits into launch momentum

Arguably, risk-free pre-deposit vaults have become the most influential meta for launching new protocols today. In this model, even before the main product is ready, a simple website allows users to deposit the protocol’s core assets – funds that are not yet actively utilized. These vault contracts are typically minimal in complexity, which makes them relatively secure.

This playbook has been successfully executed several times, most notably by the Ethena team and their associated projects – Ethereal, Terminal, and most recently, Strata Money. In each case, users can pre-deposit USDe and begin earning points while the underlying protocol is still being prepared for launch.

Moreover, these pre-deposit vaults can be (yield)tokenized on platforms like Spectra or Pendle. There, the future airdrop points accrue exclusively to the Yield Token (YT), making the Principal Token (PT) an attractive fixed-income product – its yield driven by expectations of the airdrop’s value. Ethena’s PTs, for instance, yield around 11–14%, and can even be used as collateral in lending markets to borrow against and leverage further.

What are the downsides to this approach?

This approach is essentially a cheat code when the associated protocols can also announce big fundraises, as it immediately increases the expectations of the airdrop. Smaller bootstrapped protocols might struggle getting their YT asset to a high enough valuation in order to make use of the fixed-income PT flywheel.

Furthermore, it adds an internal timer for the launch, as people start deploying a meaningful amount of capital into these strategies, any kind of delay and extension of these points campaign, resulting in further dilution of early depositors, can quickly turn your community against you.

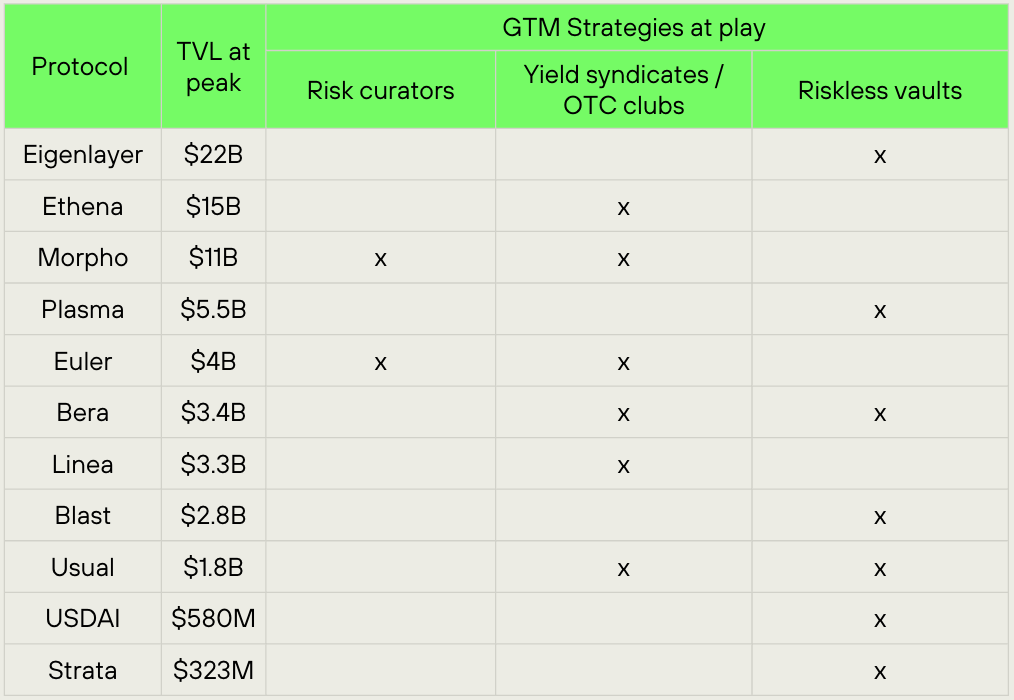

The following table shows several major launches from last year and which combination of GTM strategies used in each case.

Source: Greenfield

PART II – Riskless vault case studies

In Part I, we outlined the most successful and commonly used DeFi GTM strategies observed over the past few years. While the risk curator meta has proven valuable for strengthening established protocols such as Euler and Morpho, it is not a strategy that can independently bootstrap early activity from scratch. Yield and OTC club strategies, on the other hand, are frequently executed through private deals, making reliable data scarce. Against this backdrop, the riskless vault approach stands out as the most consistently successful and broadly replicable GTM strategy – both in its ability to jump-start protocol traction and in the richness of on-chain data available for analysis.

Building on this, protocols like EigenLayer, Blast, Berachain, and Plasma adopted remarkably similar GTM playbooks: they launched primarily risk-free deposit contracts with minimal custom smart-contract complexity. This streamlined approach enabled each of them to attract billions in deposits, setting off a powerful feedback loop – higher TVL drove stronger narratives, which in turn reinforced valuation expectations and accelerated ecosystem growth.

Eigenlayer case study

Eigenlayer began to forge its narrative in late 2022, introducing “restaking”, a novel concept also known as modular consensus. This innovation allows Ethereum’s security to be leveraged for validating diverse services, termed ‘AVS’. This new primitive quickly got widely discussed by the largest accounts on crypto twitter and with the funding announcement in early 2023 of a substantial $50M Series A round, it had the necessary mindshare to become a massive success story.

By mid-2023, the initial smart contracts were deployed. A pivotal decision at this stage was to design these contracts with little risk, both in terms of complexity and slashing; the sole purpose was to distribute Eigen points and to provide the lowest barrier to entry to absorb huge amounts of TVL. This was a pivotal decision because smart contract risk is one of the primary concerns of every DeFi user. Actively choosing a smart contract without slashing and a little complexity essentially enabled a risk-less deposit while offering significant upside via a future airdrop. This led to billions of inflows and ultimately fuelled the flywheel of increasing token valuation expectation. On top of that, the initial launch of the contract came with a deposit cap of 10k – 30k ETH, depending on the to be deposited asset, adding scarcity. In early 2024, there was a short period of time (8 hours) where the caps were lifted, which resulted in over 1M ETH being deposited. Shortly thereafter, in February 2024, a massive $100M funding round was announced, further increasing return expectations, leading to a run-up in TVL to an all-time high in June 2024 of 20B USD.

Users were able to claim their initial $EIGEN allocations between May 10th and September 7th, 2024. After the claim, the token was non-transferable – it wasn’t traded yet and consequently, there was no liquid price. The final transferability event happened on September 30, concluding the airdrop.

- Airdrop duration: The points farming and deposit campaign began in mid-2023, with the airdrop claim window running from May 10, 2024, to September 7, 2024, and full transferability on September 30, 2024.

- “Risk-free” deposits: Deposits involved no initial slashing risks or complex logic; users simply deposited LSTs to earn points while retaining base yields, with risks mitigated through audits and gradual AVS integration.

- Allocation size: 15% of the total $EIGEN supply was allocated to the multi-season stakedrop, with individual allocations varying based on points; all eligible users received a minimum boost of 100 extra $EIGEN tokens after community feedback.

- Post launch success: Post-airdrop, EigenLayer maintained strong TVL above $15B into 2025, with the token launch considered one of the more successful in 2024 despite initial backlash, of neither slashing nor any meaningful AVSs being live.

Eigenlayer’s pre-TGE campaign was a great success in terms of narrative and capital inflows. The concept of “risk-free” restaking combined with a points program created a perfect incentive loop: users faced minimal downside while accumulating potential upside through airdrop expectations.

This, alongside broad partnerships with multiple staking providers (rather than concentrating on Lido), helped EigenLayer win both mindshare and community legitimacy. That said, the execution post-TGE ended up slowing them down. By opting to make $EIGEN non-transferable for months after the claim opened, the team effectively stalled momentum. If transferability had been immediate, it is plausible that the token could have launched with an FDV of $20B, capitalizing on peak hype and liquidity demand. Instead, the delay deflated market energy. Furthermore, the absence of live, meaningful AVSs post-launch undermined Eigenlayer’s own narrative.

Blast case study

Blast emerged on the Ethereum Layer 2 scene in November 2023, introducing enshrined yield-bearing assets into their chain: by default ETH and stablecoins were yield-bearing without the need for staking or locking assets. This feature, paired with a gamified launch strategy, propelled Blast to over $1.65B in TVL by Q2 2024, cementing its position as a standout in the crowded L2 market.

Similar to Eigenlayer, Blast went to market with an arguably less novel concept but a similar risk-free deposit contract campaign, the sole purpose of which was to distribute points, while adding an affiliate marketing scheme on top to gamify the experience. Users were able to bridge ETH, which was staked with Lido, and stablecoins, which were deposited to MakerDAO’s DSR to start earning points. The founder (“Pacman”) was rather well known from his previous venture, Blur, the leading NFT marketplace at that time.

The launch of the pre-deposit campaign was announced roughly at the same time as their funding announcement of the 20M round towards the end of November 2023. The pre-deposit campaign ran until the end of February 2024, totalling a 100-day campaign. The initial timeline for the TGE was around May 2024, but ended up being delayed to June 26, 2024. This led to a lot of frustration in the community as more points were issued during the delay, further diluting the points. On the day of airdrop, 17% of the entire supply was airdropped to participants of the pre-deposit campaign, with the top 1,000 largest users having a 6-month vesting applied.

- Airdrop duration: The pre-deposit and points campaign ran from late November 2023 to late February 2024 (approximately 100 days), with the Phase 1 airdrop on June 26, 2024; Phase 2 extended rewards through June 2025.

- “Risk-free” deposits: Users bridged assets to Blast’s contracts with no lockups, earning native yields (e.g., from Lido staking for ETH) and points passively, without exposure to impermanent loss or additional smart contract risks beyond bridging.

- Allocation size: 17% of the total BLAST supply was airdropped in Phase 1, split 50% as Blast Points for users and 50% as Blast Gold for developers; contributors received up to 25.5% overall, with vesting for top recipients.

- Post launch success: After the airdrop, there was a lack of an organic user base and with the majority of airdrop farmers being annoyed by the delayed airdrop, a lot of capital ended up leaving the ecosystem, leading to a constant decrease from the peak of $2.6B to $143M that is left as of today.

Blast’s launch campaign was quite simple, pairing yield-bearing assets with a gamified, affiliate-style campaign and large KOLs posting their affiliate links. The strategy was effective in the short term: within 100 days, Blast attracted billions in deposits and positioned itself as a contender in an already crowded rollup market. The simplicity of the pre-deposit vault – a multisig contract managed by the team – reduced perceived risk and made the funnel accessible to a larger audience. Combined with Pacman’s credibility from Blur, this narrative was strong enough to generate early momentum.

By the end of the campaign, the repeated delays in the TGE compounded frustration; not only did it dilute early participants by extending point issuance, but it also signaled that the chain and ecosystem were not launch-ready. The outcome was that capital fled as soon as rewards materialized. Airdrop farmers, frustrated by dilution and locked allocations, had no incentive to stick around. Without an organic user base or compelling ecosystem to anchor liquidity, Blast’s TVL collapsed within months. The negative perception – reinforced by “down only” token price action – became self-reinforcing, pushing the project into a defensive posture.

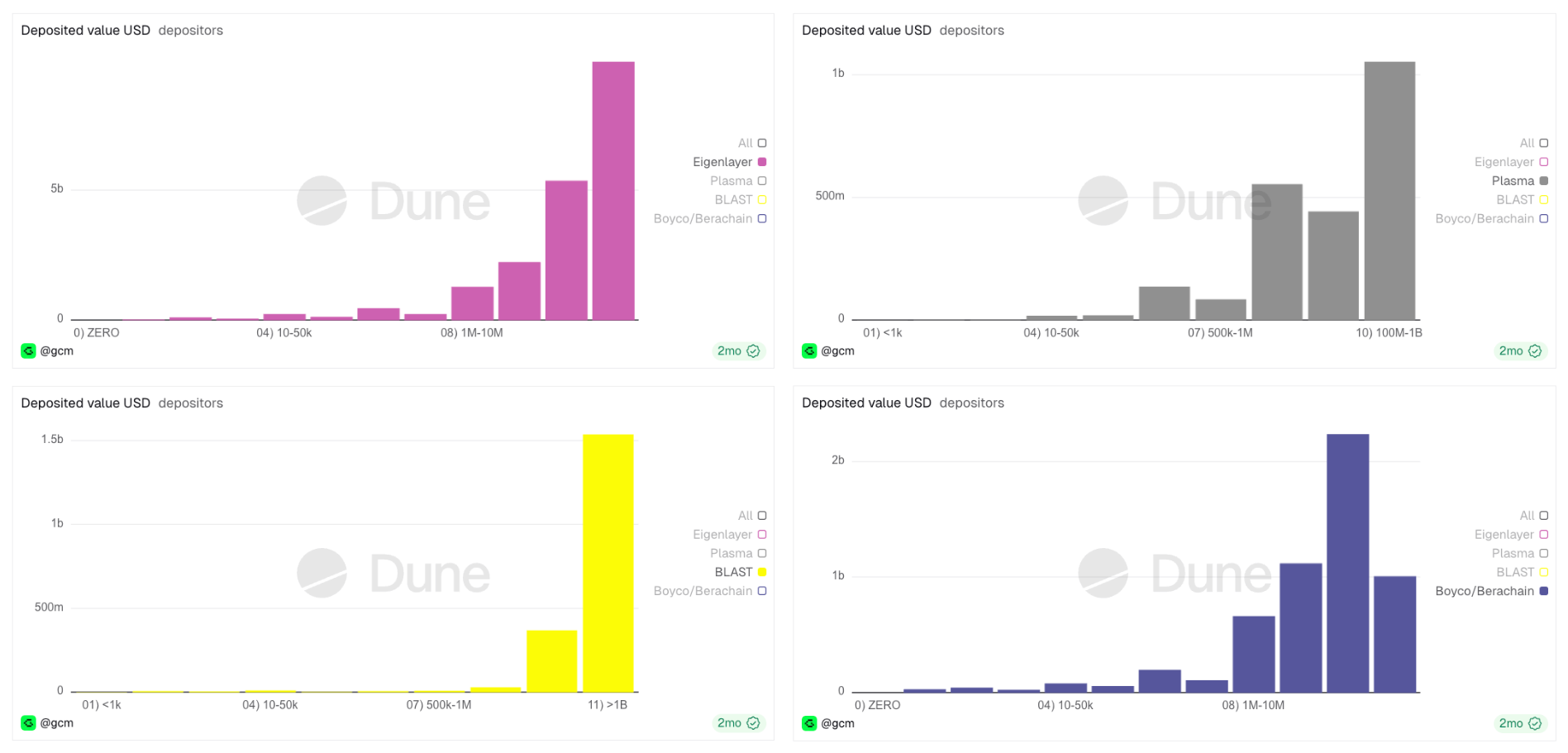

Source: Dune/Greenfield

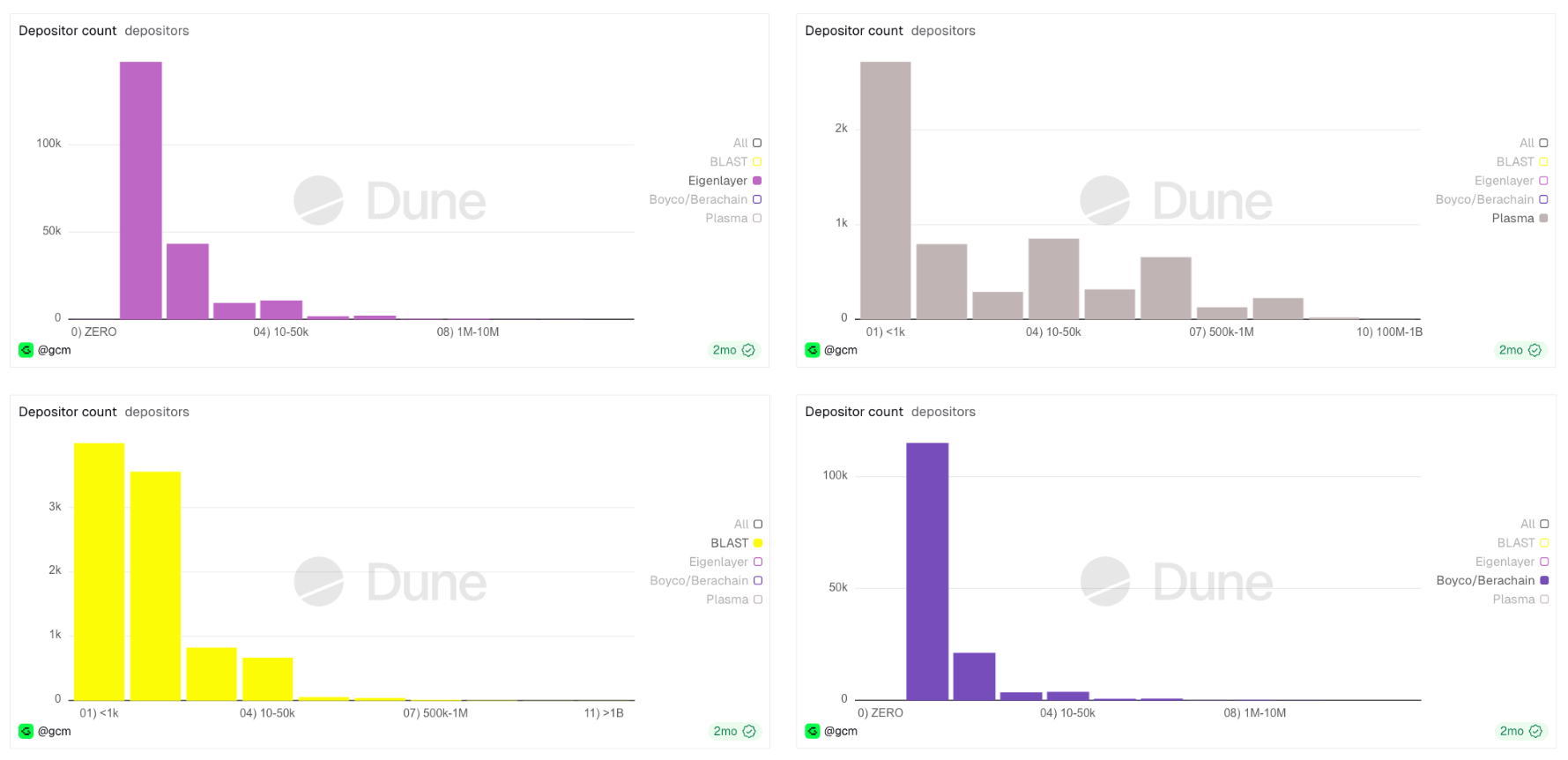

The distribution of deposits reveals just how concentrated liquidity inflows were across these campaigns. EigenLayer and Boyco leaned on a mix of whales and mid-sized depositors, Plasma saw a strong mid-tier cohort, while Blast stood out as highly dependent on a small number of mega-wallets contributing nine-figure deposits. This concentration underscores the fragility of early TVL figures: much of the “headline liquidity” in DeFi launches can be attributed to a handful of large allocators rather than broad-based adoption. What remains counterintuitive is that multisig deposit contracts are generally perceived as relatively safe, given the lack of technological complexity, where the trust in the team not stealing the funds is outsourced to VCs, for instance, who conducted protocol due diligence, which attracts large deposits in these rather centralised constructs.

Plasma case study

Plasma launch was one of the most impressive ones that the DeFi market has seen in a while. It took the team roughly 12 months from their first $3.5M raise announcement to raise $24M privately, an additional $50M via their lockdrop mechanism and ultimately launching their $XPL token, peaking at $16B FDV. Furthermore, the team did an exceptional job of branding themselves with Tether and positioning themselves as a stablecoin L1 during the stablecoin “hype cycle”. Beyond that, there were no larger delays or hiccups that could have led to frustrations or a reduction in confidence.

- Airdrop duration: The campaign kicked off on June 9, 2025 with an initial $250M deposit cap and a $50M limit per wallet. This ceiling was reached in under a minute. In response, the team raised the cap by another $250M, which was fully subscribed within two minutes. A few days later, on June 12, the deposit cap was expanded again by $500M, and this final tranche was completely filled within 35 minutes. The campaign was set to run for a minimum of 40 days, with withdrawals opening on mainnet launch.

- “Risk-free” deposits: Plasma took a similar approach via a simple one-click deposit vault but instead of simply letting the funds remain idle and not being put to use, they were deposited in Aave earning a steady yield.

- Allocation size: Plasma sold 10% of their token at a $500M token valuation. All participants received a 1-year lock-up and 12-month vesting.

- Post launch success: After mainnet and token launch, the team tried to aggressively onboard TVL onto their chain by incentivizing a variety of projects with no clear plan or direction except for blindly growing the TVL. They have spent millions of XPL incentives with no return or traction beyond “worthless” TVL sitting on the chain doing nothing. The token price reflected the disappointing post-launch execution by falling from the peak of $16B down to $2.6B at current prices.

Berachain case study

Berachain has an extremely long lore and history around their chain. Initially, just starting out as an NFT project, which then went on to raise money to build a unique L1 with consensus around proof of liquidity. Their GTM strategy stood out, as their infrastructure was seemingly not ready to handle a direct deposit campaign. To address this, the Bera team partnered with Royco, a capital marketplace that connects users seeking yield with protocols seeking TVL. Unlike the previously mentioned campaigns, all deposits had predefined allocations in various protocols on their chain. Although the initial deposit carried minimal risk, these positions would eventually roll over to actual protocols, introducing smart contract risk. For that it was quite surprising to see almost $3B in deposits. The main reason was the high expectations for the airdrop.

- Airdrop duration: The main airdrop campaign ran through early 2025, with the airdrop checker launching February 5, 2025, and claims starting post-mainnet on February 6, 2025; the primary phase ended March 20, 2025, with additional phases like Bitget Wallet extending to April 2, 2025.

- “Risk-free” deposits: Initial deposits via Royco were low-risk with predefined yield positions and no immediate smart contract complexity, though risks increased upon transition to live protocols; this hybrid approach minimized entry barriers while bootstrapping useful liquidity.

- Allocation size: 15.8% of the initial 500 million BERA genesis supply was allocated to the airdrop, distributed to community members, applications, liquidity providers, and testnet users.

- Post launch success: Following the mainnet launch in February 2025, Berachain saw rapid TVL growth exceeding $3B from pre-deposits, which unfortunately didn’t last long. The nature of the pre-deposit capital being very mercenary, it quickly started leaving the ecosystem, with the price of BERA dropping and consequently also the yields. Currently Berachain is sitting on 500M TVL with almost $200M as deposits from Solv Protocol, “real” users or retail TVL is likely below $300M.

Berachain took a distinctly different route to market compared to EigenLayer and Blast. Via partnership with Royco and the creation of Boyco, instead of passively warehousing assets, users could choose from a variety of Berachain-native protocols with the understanding that their deposits would later roll into live positions once mainnet launched. The design lowered initial entry risk while ensuring that liquidity would eventually become “sticky” by being embedded in actual protocols.

What stood out was the scale of inflows – a proof of just how high expectations for the BERA airdrop were. In many ways, this was a validation of Berachain’s long-cultivated lore and community narrative, which successfully converted into speculative inflows.

That said, the final size of the airdrop for Boyco participants was relatively thin compared to the risk profile. Many participants walked away underwhelmed by their actual BERA allocations, leaving them frustrated after such large-scale deposits. Furthermore, the post-launch price action of BERA turned against them. As token value and consequential yields declined, many started looking for different yield farming opportunities and eventually left the chain. Still, unlike Blast, Berachain retains a core group of strong believers. The founder remains highly active on X, focused on rebuilding and expanding the ecosystem – and by most accounts, appears to be making steady progress.

Analyzing wallet overlap

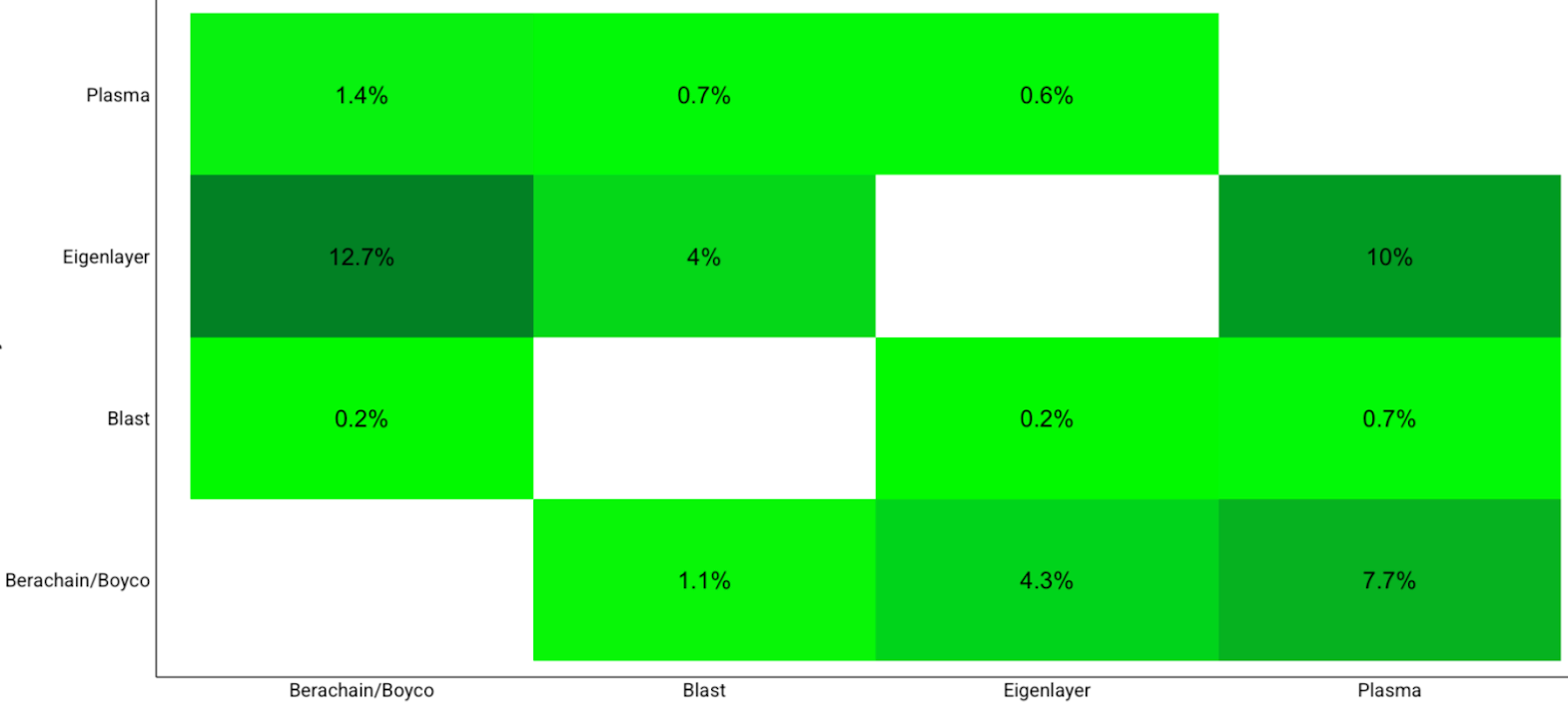

To put this into perspective, wallet overlap across projects highlights just how mercenary this capital has become. The heatmap below shows that 12.7% of Boyco depositors also deposited into EigenLayer, while 4% of EigenLayer depositors moved into Boyco – even when filtering only for wallets with more than $5k deposited. Similar overlaps exist across other projects, underscoring that a significant portion of “early adopters” are in fact the same capital cycling through multiple airdrop campaigns.

Share of depositors overlapping between projects | Source: Greenfield

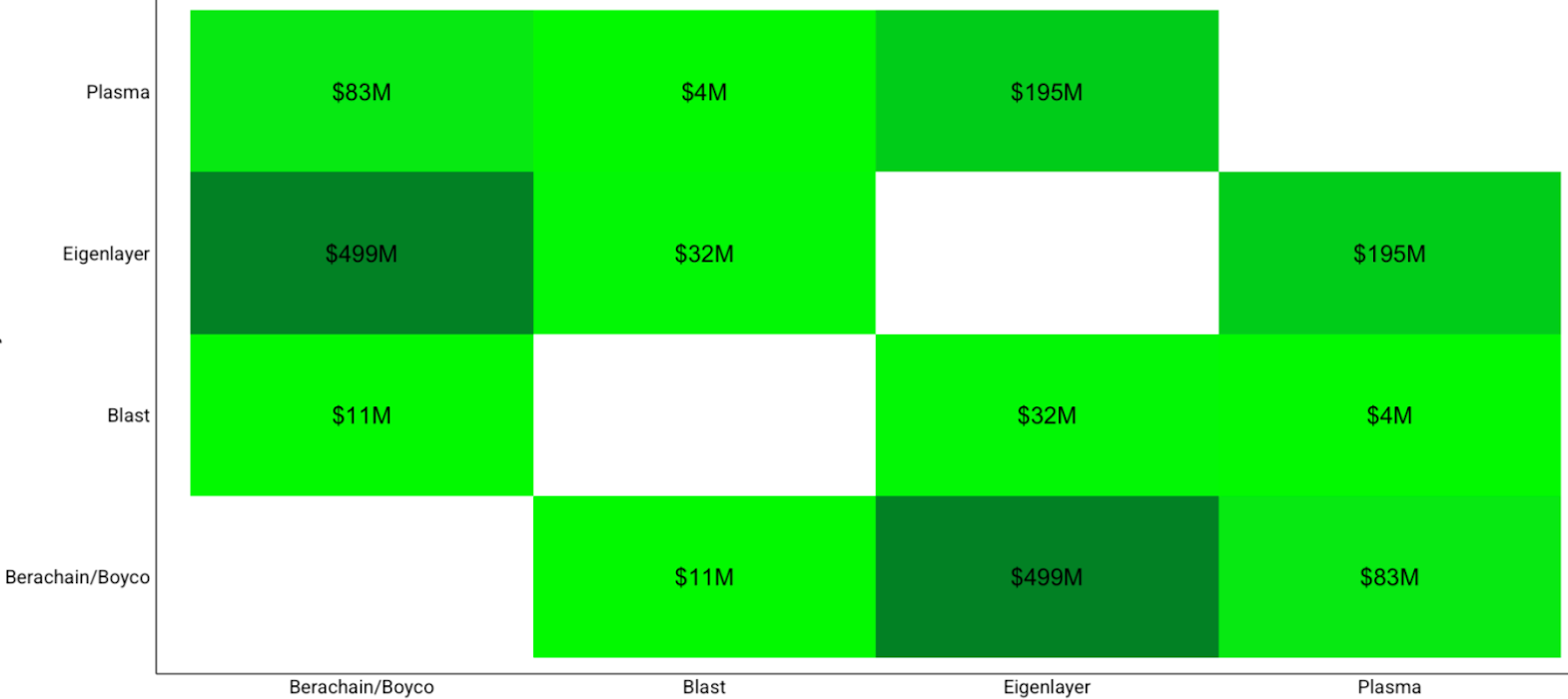

Total deposit value from wallets that were active in both projects | Source: Greenfield

Looking at depositor counts rather than raw capital paints a different picture. EigenLayer and Boyco managed to attract broad participation from tens of thousands of wallets, even if many contributed only small amounts. By contrast, Blast’s depositor base was thin, relying on a few thousand addresses with little depth beyond its whales. Plasma, while smaller in scale, shows a healthier distribution across cohorts.

Source: Dune/Greenfield

Conclusion and Takeaways

With our GTM playbook, we outlined the main strategies we have observed in DeFi when it comes to protocol launches. While “riskless” deposits and yield OTC groups were the most used strategies to bootstrap initial protocol traction, risk curation meta was primarily used for the growth stage. Given the recent Stream Finance debacle, the space is currently putting additional scrutiny on the role of risk curators, questioning the model and its utility.

The recent wave of DeFi launches shows that the GTM playbook is less about technical novelty and more about orchestrating trust, timing, and capital flows. Pre-deposit vaults, curator integrations, and points speculation via yield tokenization protocols like Pendle or Spectra are the required infrastructure to efficiently scale into billions. But these tools don’t guarantee endurance. If anything, they reveal a deeper truth: DeFi protocols are competing in the attention economy as much as in their financial offering. Success requires converting narrative-driven inflows into communities that identify with the protocol beyond speculation.

What separates lasting protocols from fleeting ones is not how much capital they can attract at launch, but how effectively they transform this initial momentum into sustained engagement. Deposit campaigns and airdrops create a window of attention, but that window closes quickly if users don’t find purpose, yield, or community alignment beyond speculation. The real GTM challenge is designing mechanisms that turn mercenary liquidity into embedded liquidity, and transient hype into durable ecosystems. Protocols that recognize this shift – treating launch not as an end, but as the start of continuous capital and community orchestration – will set the pace for the next cycle of DeFi growth. We expect the strategies to constantly evolve and morph over time; this is why it is important to review these strategies in the mid- to long-term and learn from them.