Greenfield 2026 Expectations

by The Greenfield Team – December 3, 2025

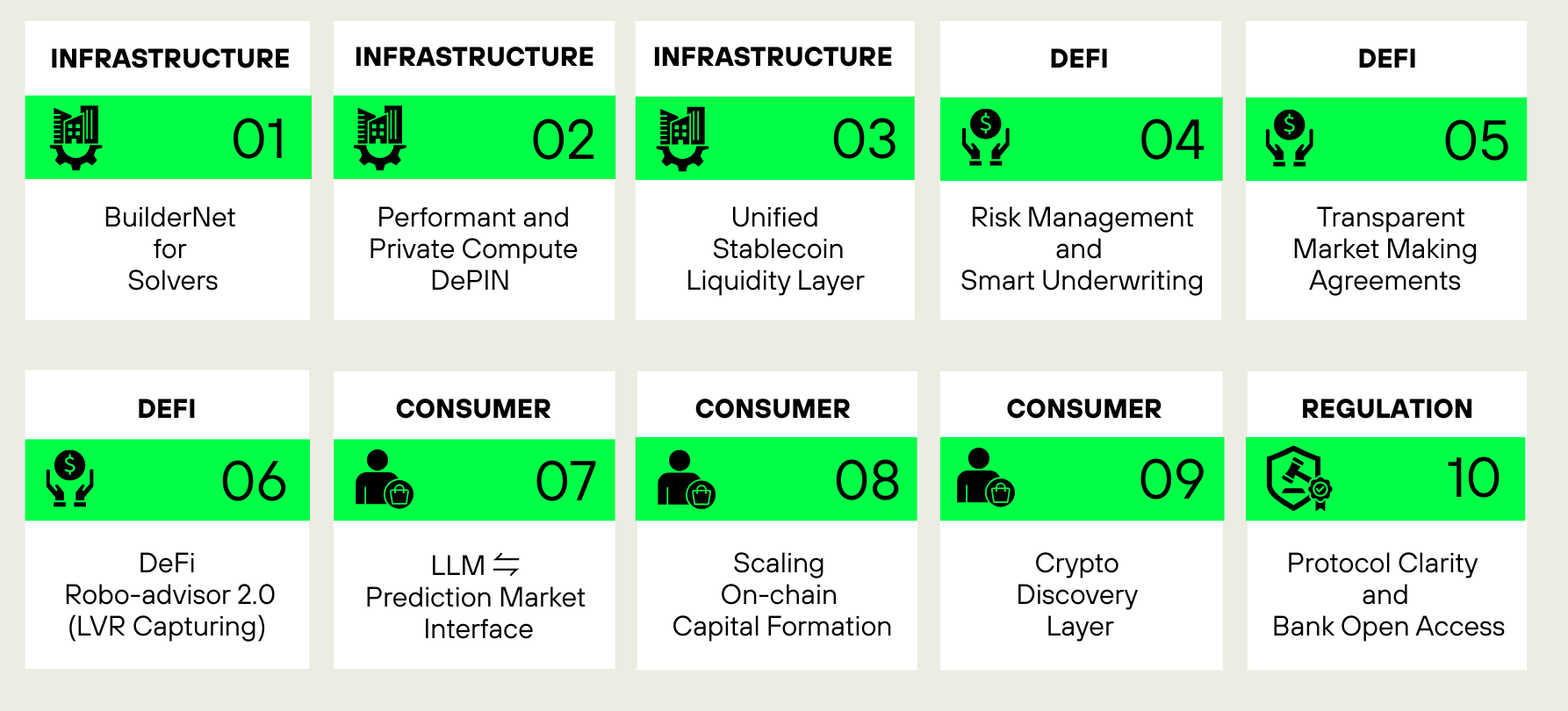

The digital asset ecosystem continues to unfold in unexpected ways: new primitives, new behaviours, new coordination tools. What looked experimental a year ago can suddenly feel foundational. As investors, our mandate is to stay close to those shifts, to understand which emerging ideas could evolve into lasting infrastructure and real market pull. Last year, we shared our predictions about what could shape the year ahead. This time, we’re taking a different route. Rather than claiming to know what the future holds, we want to share what we hope to see: a 10-point wishlist of ideas, problems, and products we’d love founders to take on in 2026. By anchoring these reflections, we gain a nuanced understanding of where the next set of meaningful opportunities may emerge across Infrastructure, DeFi, and Consumer – and in how evolving regulation will shape the ground beneath them.

1 | INFRASTRUCTURE – “BuilderNet” For Solvers

Problem:

Over 50% of all non-toxic retail order flow on EVM flows through intent-based aggregators utilizing the solver model. However, solvers often face delays when integrating new routes, due to the substantial workload required to fully understand the logic, prevent reverts, and maintain low simulation latency. This leads to a chicken-and-egg problem for many new AMMs like Uniswap v4 hooks: solvers both need existing order flow before they can integrate a new liquidity source, but they are also the ones responsible for routing most of the order flow in the first place. This disincentivizes AMM innovation as hooks often have to “lobby” large solvers for integrations or even engage in backroom deals. Especially, v4 hooks are a very broad design space where every invariant can be broken, and currently, only 4% of v4 volume flows through hooked pools.

Opportunity:

BuilderNet by Flashbots coordinates independent instances of block builders in TEEs to share order flow and coordinate mev-boost bids. A similar idea could also apply to the solver market, where solvers could trustlessly coordinate and share things like intent order flow, RFQ integrations, analytics/liquidity indexes, routing integrations, as well as collaborative solving, where intent auctions are sold on wholesale and more.

2 | INFRASTRUCTURE – Performant & Private Compute DePIN With Hybrid Cryptography & Hardware-based Security

Problem:

TEEs promise “private AI in the cloud,” but recent side-channel attacks show they can still leak data – especially in a decentralized, permissionless setting. On the other hand, pure cryptography (MPC/FHE) is very safe but far too slow and complex for most real AI workloads. There’s no easy platform that gives you TEE-level speed plus a cryptographic safety net and clear, usage-based billing for models.

Opportunity:

The product is a secure AI runtime that by default runs models in fast TEEs, but automatically routes the most sensitive steps through a small MPC cluster and records verifiable “proofs of correct execution” and metered usage. Customers get cloud-like performance, audit-ready privacy guarantees, and built-in monetization for model providers. This is crucial for regulated industries and increasingly broad target audiences since ultimately businesses and consumers increasingly rely on AI to greater extents and exposing sensitive data becomes a threat to IP ownership, and in turn profitability, as well as freedom.

3 | INFRASTRUCTURE – Unified Stablecoin Liquidity Layer

Problem:

A stablecoin liquidity layer provides a shared infrastructure for stablecoin exchange and settlement across multiple blockchains. Rather than maintaining separate liquidity pools on each network, liquidity providers contribute to a unified reserve that can be accessed from any chain. A coordination mechanism tracks aggregate balances and instructs local contracts to deliver funds where transactions occur. Liquidity is dynamically rebalanced to meet demand, maintaining consistent depth and pricing efficiency across connected ecosystems.

Opportunity:

Such infrastructure addresses one of DeFi’s core inefficiencies – the fragmentation of stablecoin liquidity. By consolidating it, stablecoin transfers and conversions become more capital-efficient, cheaper, and predictable. This architecture enables lower slippage for traders, higher utilization for liquidity providers, and a common settlement layer for payment, treasury, and stablecoin-based applications. It would represent a foundational step toward frictionless, cross-network financial infrastructure.

4 | DEFI – Risk Management And Smart Underwriting

Problem:

Risk management in DeFi remains a large and mostly unsolved topic. There are multiple ways to manage risk, from in-protocol and governance methods to outsourcing it to risk curators.

Opportunity:

It is not surprising that in a highly competitive space like crypto, some entities are willing to push the risk limits, especially in the absence of clear guardrails or frameworks to make these risks visible to the broader market. One way to address these risks is through clearer risk separation, for example, by introducing structured tranching or other mechanisms that allocate exposure more precisely among participants. Historically, limited historical data, weak trust frameworks, and insufficient risk-monitoring infrastructure have made it difficult to price and distribute risk effectively, resulting in prohibitive costs. Today, however, tooling is improving, confidence in DeFi is rising, and the ability to assess on-chain risk is becoming more robust. This is gradually narrowing the gap between those seeking yield and those willing to take on specific forms of risk. We would like to see more experiments focused on structuring and mitigating risk across DeFi systems. There is also a lack of industry-wide standards for risk scoring and protocol interdependencies, which are often hidden behind complex code. This creates an opportunity for a DeFi-native real-time on-chain risk scoring entity to emerge.

5 | DEFI – Transparent Market Making Agreements

Problem:

Market Making (MM) agreements remain one of the most intransparent and opaque parts of the industry, where the actual terms of agreements are rarely disclosed. Many token project teams lack visibility and control over these deals, leading them to overpay for MM services as a result of not having a complete view of the market. They also tend to give away larger portions of their token supply than is necessary, and spend considerable time learning what a good MM deal should look like. While it is partly a social coordination problem, in which investors and exchanges (or regulators) can demand more disclosure, coordination remains hard.

Opportunity:

We believe there are opportunities to improve the efficiency of this market with innovation. A simple aggregated frontend where projects or MM could post deal offers with parameters they are willing to fulfill could be useful. Coinwatch is already improving visibility in market maker behavior by putting API keys in TEEs, allowing projects to track what their MMs are doing. We could also see the use of a combination of zkTLS and stake to enforce certain behavior (especially for less brand-heavy MM) at all times, e.g., stake slashing if bid-ask spread (or any other metric) goes beyond a certain threshold.

6 | DEFI – DeFi Robo-Advisor 2.0 (LVR Capturing)

Problem:

Today’s auto‑investing tools don’t capture on-chain microstructure alpha at scale.

Opportunity:

There is an opportunity to leverage LVR‑capturing AMMs (batch auctions, solver rebalances, dynamic fees) so “arbs” pay our portfolios, while asset allocation ratios remain balanced (hint: impermanent loss is a feature and not a bug if you explicitly want a rebalanced portfolio). This could potentially look like a DeFi robo‑advisor that turns arbitrage into yield. Tokenized RWA funds / ETFs (AAA-rated fixed income, MMFs, S&P500) are growing fast, complementing the crypto native investable asset universe (BTC, staked ETH etc.). Account abstraction enables simple UX: smart contract-enforced strategies provide transparent risk controls, compliant wrappers provide regulated yield-bearing tokens. Battle-tested infrastructure with insurance potentially layered on top provides state-of-the-art security. Asset allocators get auto-rebalanced portfolios and traders get liquidity. Smart contract disintermediated win-win – the individual lego blocks are here – someone needs to assemble them for scale.

7 | CONSUMER – LLM ⇋ Prediction Market Interface

Problem:

Prediction markets have found wide adoption, new markets are created daily, but discovery remains an issue. Users today browse the frontends of those prediction markets to find markets that suit them or use external aggregators or frontends for discovery, most of it on a filter basis – manual and slow. There’s no intuitive way to simply state a forecast (e.g., “Team A will win”) and act on it. As a result, most potential bettors never translate their opinions into on-chain bets.

Opportunity:

Discovery in prediction markets could be solved through an LLM-driven interface. We believe a chat-like front end that parses user predictions and routes them to the optimal on-chain market would collapse UX friction, dramatically broaden participation, and, with more predictions creating more liquidity, make prediction markets even more dominant than they are today.

8 | CONSUMER – Scaling On-chain Capital Formation

Problem:

On-chain capital formation tools (Echo.xyz, pump.fun, Zora) have validated that community-driven capital-raising works on-chain, but participation today is largely limited to crypto-native users. Now, it is time for those models to break out of the crypto-native crowd into the mainstream through distribution.

Opportunity:

Echo’s acquisition by Coinbase is the first step in this direction. We’ll see the next big step in on-chain capital formation – the embedding of these primitives into mass-market rails. Imagine white-labeling on-chain token/equity sale infrastructure inside apps like Revolut, Nubank or Kickstarter to reach hundreds of millions of users globally. This will unlock massive new capital pools and scale proven crypto fundraising models far beyond niche token buyers.

9 | CONSUMER – Crypto Discovery Layer

Problem:

Crypto still lacks a unified “landing page” or search engine. Existing tools cover narrow slices, forcing users to rely on crypto Twitter and scattered forums for discovery. No platform assembles all relevant info (prices, on-chain metrics, news, social, yields, governance, attention, sentiment) in one place. This fragmentation means that most participants today use a complex and broad set of niche tools to be informed and aware of what’s going on in crypto.

Opportunity:

Aggregation in crypto has been siloed and no one has solved the discovery problem in crypto yet. We see an opening to build a polished, AI-driven landing page (a true “Google for crypto”) that ingests on-chain data, news feeds, and social signals into a coherent search/discovery feed. Capturing this role would lock in early adopters as well as new entrants, creating a powerful distribution moat as crypto adoption grows.

10 | REGULATION – Clear Rules for Protocols and Open Access for Banks

This is obviously not a challenge any single protocol can solve on its own — it requires coordinated engagement across the entire ecosystem. And because regulatory clarity is so foundational to everything we build next, we’ve included it in this wishlist as a shared expectation for all of us in the industry to push forward together.

Problem:

Despite substantial advances, regulatory frameworks continue to play a significant role in shaping the pace of crypto’s next growth stage. Decentralized protocols still lack clear, fit-for-purpose rules: the U.S. provides no definitive criteria for when tokens cease to be securities, and the EU has no explicit decentralization standards under MiCA. Frameworks built for intermediaries impose inappropriate burdens on decentralized systems and introduce legal uncertainty for protocol design, token architectures, and ecosystem participation.

At the same time, regulated financial institutions – especially banks – have been effectively excluded from crypto due to Basel III rules assigning a punitive 1,250% risk weight to most digital asset exposures. This has prevented banks from investing, providing liquidity, or supporting ecosystem development. Together, unclear decentralization rules and restrictive prudential standards fragment markets, reduce liquidity, and prevent both protocols and institutions from engaging with confidence.

Opportunity:

Clear, globally aligned regulatory standards would unlock both innovation and institutional participation. For decentralized protocols, simple and transparent criteria – such as the U.S. Clarity Act’s maturity test – would finally give teams the certainty needed to design architectures that are appropriately regulated for their risk profile. Europe can follow suit by adopting practical decentralization thresholds rather than ambiguous or overly complex tests.

On the institutional side, ongoing Basel III reassessments and emerging U.S. proposals to treat stablecoins differently reflect growing recognition that current rules are misaligned with actual risk. Updating prudential standards would allow banks to hold digital assets, participate in DeFi, and provide new liquidity channels. Combined, these reforms would create a regulatory foundation that supports borderless decentralized innovation, enables institutional capital to flow into the ecosystem, and broadens access to global liquidity without compromising consumer protection.

Reach out

If you are building in any of these opportunity areas – or if you’re working on crucial disruptions we haven’t mentioned here – we’d love to hear from you.