Br3akthroughs #10 – The Rise of Fundamentals

by Markus Hujara and Sehjal Agarwal – December 5, 2025

The Rise of Fundamentals

Over the past decade, blockchain has proven one foundational idea: value can be transferred without intermediaries. While short-term token performance often dominates the conversation, it can easily obscure how far the space has evolved from that initial premise. A look at our latest investments and research highlights how this core idea is now being extended in various directions:

-

The actors sending value no longer need to be human:

Blockchain technology enables an emerging agent economy – autonomous systems transacting on-chain – while simultaneously protecting human identity and privacy through cryptographic primitives. -

The original asset itself is evolving:

Bitcoin is shifting from a passive store of value to capital that can be programmed, activated, and put to work. -

The market participants have changed:

Institutional investors are reshaping market cycles and pushing fundamentals, such as real usage, fees, and revenue, back to the center of valuation.

In this edition, we explore how that shift takes form, from Peaq’s machine infrastructure to Semantic Layer’s agent coordination, Self’s human identity layer, and BitcoinOS’s programmable utility. Together, they sketch the blueprint for a world where the human and the autonomous operate on common rails while fundamentals catch up.

Contents of Br3akthroughs issue #10:

- Backing: Peaq | Self | Semantic Layer | BOS

- Building: Validator node on Peaq

- Broadening: Fundamentals and DeFi valuations | 2026 Expectations

- Community: Stages and meet-ups

Don’t miss out on portfolio updates and recent research publications: Subscribe to Br3akthroughs here.

_Backing

Peaq – The purpose-built blockchain for the Machine Economy

Millions of machines are coming online as autonomous economic actors – robots, vehicles, sensors, AI agents. But today’s blockchains weren’t built for this. Machines need real-time coordination, machine-native identity, trusted data exchange, and seamless value flows. Existing networks can’t provide that at scale.

→ That’s why we’ve built a position in Peaq, the first Layer-1 purpose-built for the Machine Economy. Peaq embeds machine identity, payments, permissions, and data verification directly into the protocol, allowing devices to authenticate, pay, and interact autonomously – no platforms, no intermediaries, no centralized choke points. More than 60 DePIN projects and 6M+ connected devices are building on Peaq today, using it as the settlement and coordination layer for machine-driven applications. Our investment rests on a simple belief: machines will become one of the largest categories of on-chain economic activity – and Peaq is the network best positioned to power that shift.

–> Backing post

Self – The leading digital identity infrastructure for the internet

As AI agents grow indistinguishable from humans in how they speak and transact, users are facing a major new problem: the internet is losing its ability to distinguish what is real.

→ That’s why we led Self’s $9M seed round. Self provides the missing identity layer that keeps the internet authentically human while preserving privacy at every step. Instead of relying on fragile, centralized KYC databases or locking users into biometric systems, Self uses zero-knowledge proofs derived from trusted attestations, such as passports and government IDs, to prove age, uniqueness, or compliance without revealing any personal information. It’s a simple premise with massive impact: verify what’s true about a person, without exposing who they are. Self already works at a global scale: With 8M+ users across 129 countries and integrations with partners such as Google Cloud, AAVE, Aerodrome, Opera, Coinbase, and more – Self is becoming the human verification standard for an internet that will soon be shared with billions of autonomous agents.

–> Backing post

Semantic Layer – Sequencing sovereignty for the Agent Economy

With machines empowered (Peaq – above) and humans verified (Self – above), one piece is still missing: sovereignty. AI agents can act, but they can’t control how their transactions are sequenced, priced, or executed. Today, validators and rollup sequencers decide all of that – not the applications or agents generating the transactions.

→ That’s why we led Semantic Layer’s $1.5M Series A. Semantic introduces application-controlled execution: a dedicated sequencing layer that lets developers define verifiable ordering rules, aggregate agent activity, recapture MEV as protocol revenue, and build entirely new primitives for agent-driven markets. Their live deployment, 42, already hosts thousands of autonomous agents settling microtransactions with machine-native standards – an early glimpse of on-chain markets where humans aren’t the primary participants.

–> Backing post

BitcoinOS – The utility layer for bitcoin

Bitcoin (BTC) is a $2.2T asset – yet almost all of it just sits there. It can’t be programmed, it can’t generate yield, and it can’t be used as collateral natively. For the largest digital asset, that’s an enormous unrealized opportunity.

→ That’s why we led the $10M strategic round in BitcoinOS (BOS), the utility layer designed to make Bitcoin productive. BOS turns BTC from passive “digital gold” into active capital by using zero-knowledge proofs to enable true Bitcoin L2s, trustless interoperability, and fully programmable tokens – all secured by the Bitcoin blockchain itself. With breakthroughs like Charms and Grail Pro, BOS unlocks native BTC liquidity for DeFi and institutional applications without bridges, wrapping, or custodial risk. For us, this marks a fundamental shift: Bitcoin is no longer just something you hold – it’s something you can use. And that’s the step that brings real utility, real yield, and real institutional adoption within reach.

–> Backing post

_Building

Validator node on Peaq’s network

As part of our ongoing partnership and investment in Peaq, we have launched and operate a validator node on the Peaq network. Our validator plays a crucial role in ensuring the Peaq blockchain remains secure, decentralized, and efficient. Validators verify and confirm transactions, help maintain network consensus, and ensure that data on the blockchain remains accurate and tamper-proof. By running a validator, we directly contribute to the network’s integrity and stability, supporting the ecosystem’s growth and the broader adoption of machine-driven, decentralized technologies.

_Broadening

Report – Do fundamentals drive DeFi valuations?

As DeFi matures and institutional participation increases, one key question for investors is whether valuations are starting to reflect real economic performance instead of sentiment – similar to traditional assets like equities. Our latest fundamentals study indicates this shift is beginning: by 2024–25, key on-chain metrics such as TVL, protocol fees, and revenue account for up to 88% of six-month valuation variation, with models based solely on fundamentals outperforming market-only benchmarks by an average of +8.7 percentage points. The chart illustrates how this signal becomes stronger over time, turning positive in late 2023 and accelerating through 2024, and even remains in bearish periods. The paper, which has been covered by media outlets such as Blockworks and DL News, among others, aims to assess whether DeFi markets are becoming more efficient and to quantify which KPIs matter most as the sector evolves toward an internet-native financial system priced increasingly on usage, cash flows, and durable traction.

Greenfield 2026 Expectations

As we finish a milestone year for digital assets, it feels right to look forward and imagine what the next chapter could bring. Our job isn’t to predict the future with certainty, but to stay close to these shifts and recognize where meaningful opportunities are brewing. Still, it’s common to publish predictions for the year ahead – and we’ve done so ourselves. This year, we’re choosing a different angle: Rather than claiming to know what will happen, we’re sharing what we hope to see: a wishlist of problem-opportunity pairs we believe are ready for builders to tackle in 2026.

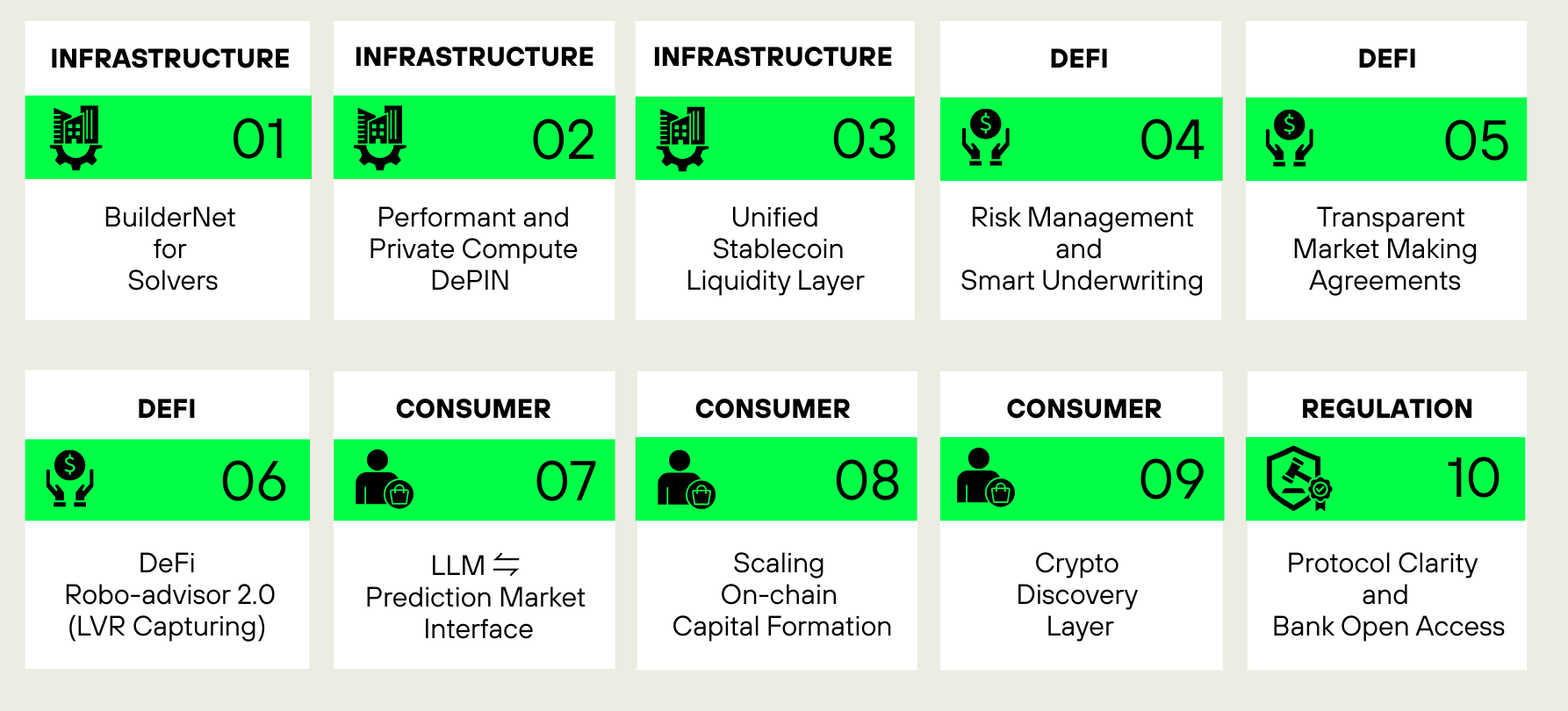

Our non-exhaustive list of expectations spans Infrastructure, DeFi, Consumer, and Regulation. From unified stablecoin liquidity and LVR-capturing robo-advisors to AI-driven prediction market interfaces, these areas hold significant untapped potential.

_Community

Top 7 stages and meet-ups

Across key hubs in Asia-Pacific, the Middle East, North America, and Europe, the Greenfield team contributed to discussions spanning both crypto-native communities and leading institutional audiences:

1. At TOKEN2049 Singapore’s Multichain Day, Principal Claude Donzé moderated a deep dive into “The DeFi Stack”.

2. Founding Partner Sebastian Blum joined the Global Blockchain Congress in Dubai to highlight how DePIN is shaping decentralized infrastructure.

3. In New York, Founding Partner Jascha Samadi presented the core findings of our latest research on Defi fundamentals and how they impact valuations (see “Broadening” section) at The Bridge.

4. In Berlin, Partner and COO/CLO Christian Zimmermann explored the path from pilots to implementation at DigiFin’s panel on DLT in financial markets.

5. In Dortmund, VP Markus Hujara spoke at Conf3rence on the role of investment firms in fueling innovation across the digital asset ecosystem.

We continued our evolving LP dinner series, bringing founders from our portfolio into the conversation:

6. In Hamburg, Lukas Steiner, Co-founder and COO of Arcium, joined us for a discussion on confidentiality as a prerequisite for institutional crypto adoption.

7. In London, we reunited some of our LP network for an evening focused on the advances in RWA tokenization, featuring insights from Jürgen Blumberg, COO of Centrifuge.

Across these touchpoints, one theme stood out: the increasing convergence between traditional institutions and the crypto-native ecosystem, and the growing importance of forums that bring both worlds together. It’s a bridge we’re committed to strengthening in 2026.